- OnTheDocket

- Posts

- How You Trade The Natural Gas Breakout Situation

How You Trade The Natural Gas Breakout Situation

⚾PRE GAME WARMUP

Happy Monday...

We've got a pull back slash retracement of Friday's squeeze operation...

The first question that comes to mind is whether or not Friday's squeeze is the fake out or will this be a small retracement from the squeeze with another leg higher on deck...

Since we don't know yet, we'll use the numbers as our guideline...

Let's look down first. Remember the elusive [Member Login] area that took a few days for the bulls to figure out how to get above?

Well, on the way back down that same area is support aka the last breakout area in the sequence...

Getting below will open the doorway for a whole new leg lower which will be posted in real time as and if needed...

The flip side situation has price staying above [Member Login] which opens the door for 430.95. If above she'll start working on Friday's highs and then the next leg higher in the squeeze operation...

Where we'll start the discussion about a test of the neckline of the heavily mentioned and touted head and shoulders chart pattern...

There are places and numbers in between, but we start with knowledge of the big picture and work backwards from there, in real time...

🎬THINK IN PICTURES

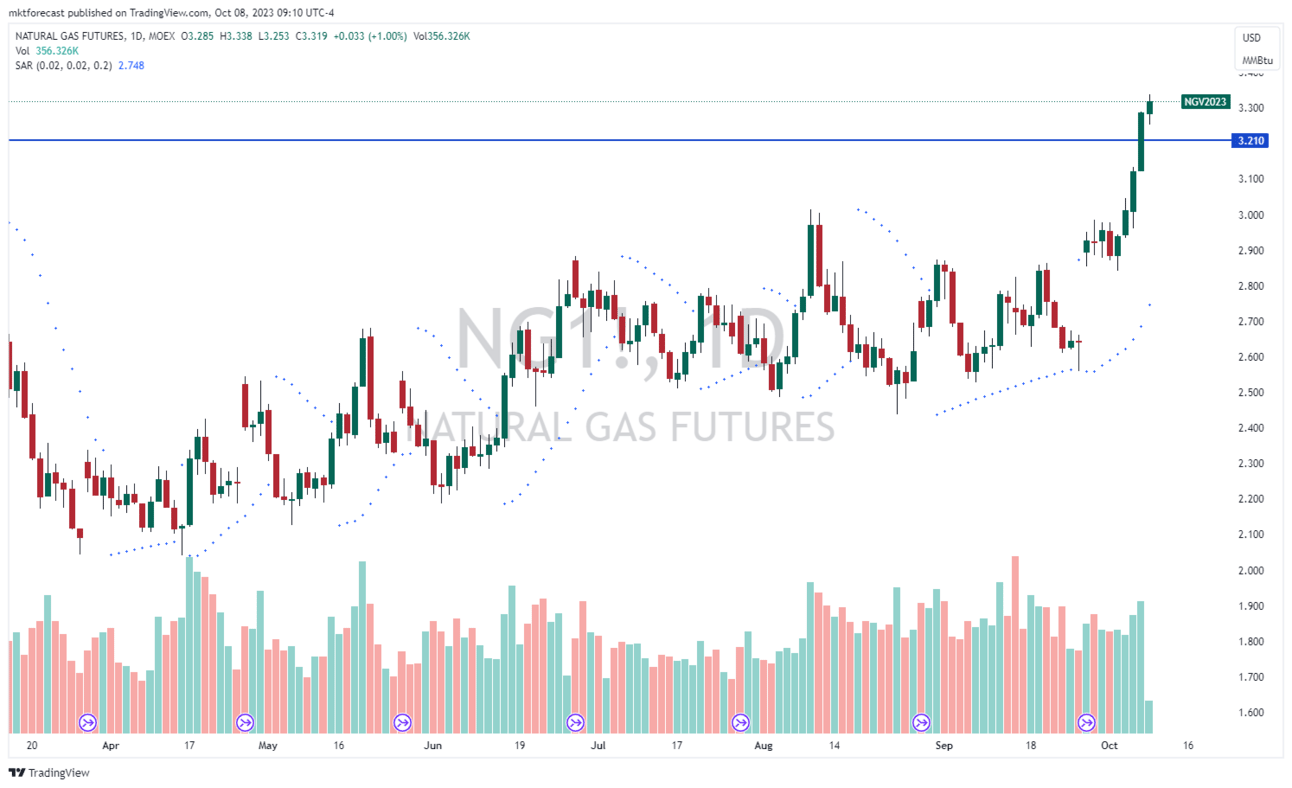

How you trade the breakout in Nat Gas.

We don’t chase markets. However we would like to participate in a breakout of a commodity that has a lot of upside potential.

What happens next is the media catches on to the breakout move, people will chase the price at about the exact time it will begin to pull back. Happens eleven out of ten times.

What trades can do is wait for the pull back and buy em’ right from the people who are giving up during the pull back.

Where is the first likely place to retrace to? 3.21 give or take… What if that doesn’t work you might ask. Then the next obvious place is the big phat round number of 3.00 and a likely spike below to around 2.94 creating a zone of support…

🌗RECYCLE TIN FOIL HAT

Big deal in the sky. The end of this week in October 14 is an Annual Solar Eclipse.

Not to mention it’s the day after Friday 13th… Interesting to watch if nothing else…

Has anyone does the homework of the impact on Financial Markets?

Share OnTheDocket

You currently have 0 referrals, only 5 away from receiving Free Month InsideTheNumbers LIVE.

💣WRECKONOMICS

It wasn’t too long ago the push began for a never ending increase in minimum wage and benefits for entry level employees.

“Everyone deserves a living wage” they said. While that’s virtuous on the surface, it’s not realistic at its core.

Don’t listen to what they say, watch what they do. Big companies such as Wal Mart, Target and others with deep pockets championed the cause out of one side of their mouth, while planning a squeeze out of the other…

The plan was to automate many of the mundane tasks that would replace the lazy, unskilled and entitled workers.

Enter the self help organization. We go to the store to get necessities for the family. Can’t find something? No problem, we used to be able to get some assistance when needed from employees “on the floor.” Today, you’re lucky to find one who’s in the “customer assistance” department. Let’s say you run into someone who would know were to find the item you’re looking for, in concept.

Excuse me, can you please tell me where to find the “your favorite item.” What happens next is fantastic. They mumble something in a version of a language you’re not familiar with and point in a direction.

You walk away befuddled with no idea what that person said, let alone where to find the stuff you need.

Less and lower skilled employees cost less. But wait, there’s more.

In an effort to reduce costs further, they installed the wonderful and never working right self checkout automation section.

The machines would reduce the need for more workers while driving down the largest expense they have, human capital.

But wait, there’s still more…

Lower cost of running the business would allow them to pass the saving along to John and Marry Lunchbucket. Sounds like a good deal, right?

Wrong. They forgot one thing. Self checkout, even with a fair amount of forethought into theft doesn’t work.

There’s always a broken unit or two in every store, maintenance, repair and IT costs go up. That’s manageable in large part. What’s not is the amount of sticky fingers that show up in the self checkout line. Dishonest consumers are finding ways to make off with tons of merchandise in the midst of the self checkout chaos department.

Now we’ve got a situation working backwards. Automation has now contributed to wide spread theft, increase costs and lower profit as a result.

How do they rectify the situation. Raise prices.

🩺PSYCH WARD

Where you one of the many traders who tried to short the market multiple times on Friday?

How do I know there were many?

If you’ve been in the LIVE Trading room, then you’ve hear me say something like: “there aren’t a lot of guarantees in the market, but a short squeezes and rip your face off rallies in a bear market phase is one of them, and it’s coming…”

The powers that be such as Mrs. Market, Trick & Co. and the trading Gods have a system in place that won’t allow most traders to be on the bus for the ride down or squeeze back up.

They did a masterful job on Friday by using the phony jobs number as the catalyst. (See the later part of Friday’s Wreckonomics section for a little foresight and twilight zone stuff) Mrs. Market killed the tape which immediately whipped out the call buyers from Thursday who guessed at a pop on the number.

Trick & Co. sucked in the shorts Friday morning. These traders were sure they would catch a big time sleigh ride down, including a crash on Monday.

Then the trading Gods reversed the tape, began squeezing out the shorts at the same time enticing news one’s to the party as price began to rise.

All shorts were squeezed out and scores of traders keen enough to recognize what was happening were left at the alter waiting on a decent pull back operation that never happened…

This is how it works over and over, we’ve all seen it before. Traders in the LIVE Room, InsideTheNumbers and watchers of the common sense market analysis videos you YouTube knew it was coming. It was just a matter of from where and when…

We don’t short “in the hole.” We know where the market “breaks the chain” on the downside (or upside), which is where a squeeze can begin…

🏆MEMBERS SAYIN’

If there was an award for the most articulate person in the trading parlots, David would win it globally every single year. @janrehak5763

COMMON SENSE MARKET STUFF EVERY DAY

DISCLAIMER STUFF: Nothing found in this communication is financial advice. This newsletter is strictly educational and not intended for or should be thought of as investment advice or a solicitation to buy or sell any assets or to make any financial decisions whatsoever. Please be careful and always do your own homework.