- OnTheDocket

- Posts

- Where You Tune Into Netflix To Buy A Bottom

Where You Tune Into Netflix To Buy A Bottom

⚾PRE GAME WARMUP

The overnight crew edged higher in a what was a rather quiet Globex session. They're waiting on the CPI dater shuffle at eight thirty this morning.

As usual, we'll play the umpire and call some balls and strikes on both sides of the tape. First we'll take the bull case where the bogey for another leg higher is [Login Here].

Getting above and staying above opens the door for the next leg up to [Login Here] give or take...

If they can push above, we’ll come to the window in a real time posting type situation as and if needed...

The flip side case has price getting below [Login Here] which opens the door for Mrs. Market to fall in what could appear to be a shakeout operation...

[Login Here] would be a destination and support.

The wipe out situation begins if she gets below 433.15 which will be then handled in a real time formation as and if needed...

🎬THINK IN PICTURES

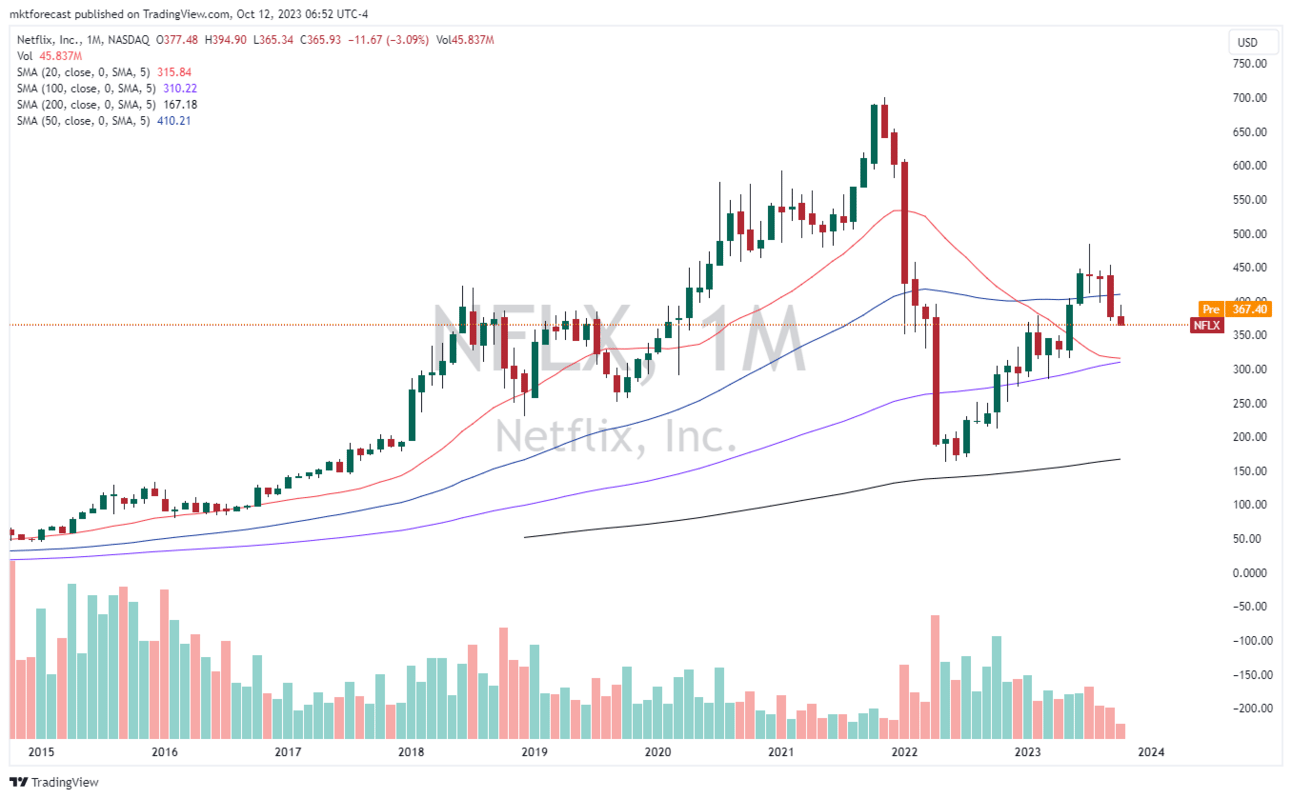

The chart below is Netflix (NFLX) and it tells a story. This one is a classic lesson in the stuff we teach. Looking at the long term view of what happened and more importantly, what’s expected to happen going forward.

We’ve got a big time bear wedge pattern that topped out over the summer with one of those famous signs or signals of a trend change, in an on time situation.

Where is she going and where is support? How about the $325.00 - $330.00 zone? It represents a garden variety retracement, a former breakout area and if on time will represent a buy em’ with both hands type of situation.

Getting there by year end would represent another on time situation for a bounce back in the other direction. Not to mention, nobody will want it at that point in time, at that price… Right up our ally.

🌗RECYCLE TIN FOIL HAT

Simple reminder, markets have a tendency to trade up or down into tin foil hat events.

October 14th is the annual Solar Eclipse which qualifies as such an event.

Share OnTheDocket

You currently have 0 referrals, only 5 away from receiving Free Month InsideTheNumbers LIVE.

💣WRECKONOMICS

Can we have a discussion about sustainability and probabilities?

The US national debt is rising at such a fast pace it will soon require bigger payments than our national defense program to keep the band playing on.

Nobody would run their household with such recklessness and disregard for the way money works.

We borrow money to fund other countries, programs we don’t need and a wide variety of the ridiculous.

After all, we have people sleeping on the streets in most cities across the country, yet we send money to foreign lands most Americans couldn’t find on a map.

As interest rates continue to rise and we continue borrowing money by the billions, it stands to reason our lenders will start to get nervous they’re not getting their money back.

The US is the richest country in the world, they say. Well, that sounds great and reassuring to the uninformed, but those that can read a standard issue balance sheet know otherwise…

When a child does bad stuff and nothing happens, they keep doing bad stuff. Why would congress stop the spending when there are no negative consequences for the continued borrowing.

We spend more than we take in which requires us to borrow the rest. What happens when the lenders stand up and say “no mas, we’re not approving the loan this time…

It’s called a failed bond auction and the beginning of the end.

🩺PSYCH WARD

How about a little “Confirmation Bias” today. What is it? The tendency of people to favor information that confirms or strengthens their beliefs or values and is difficult to dislodge once affirmed.

How does it work in trading and investing?

Well, the current scenario is the perfect example. Before last Friday’s rally that extended into this week the market was headed for the abys. In the LIVE Trading room, each time the topic of the pending “rip your face off rally” was discussed, like clockwork some of the traders would post comments about an item from the wall of worry.

It was interest rates, the economy, the consumer, housing market, you name it, there were countless reasons why the market couldn’t possibly rally and would continue to fall precipitously.

The effort was made many times to explain that while those things are all real, they have nothing to do with the pending rally that would proceed to wipe the floor with the shorts…

The market is not the economy and the economy is not the market. We already know the market is designed to trick, trap, fool and frustrate as many investors and traders as possible. Bear phases have sharp and fast rallies that eat up points faster than Joey Chestnut eats hot dogs.

But what about all the news? There’s always a never-ending supply of bad news to chose from and it’s all real and present, however it has no impact on today’s market. We can all see how fast the media turns on a dime once markets start to recover, the conversation quickly goes from doom and gloom to 4th quarter recovery, soft landing and “the Fed is likely done raising rates.”

The bias comes in when you refuse to take the present price movement at face value and continue searching for articles and stories about all the negative things resident in the economy, supporting the case for further downside. You blow right on past the headlines that don’t support the negative case, can’t read those, they make no sense. So you stay short, readying for a pie in the face.

🏆MEMBERS SAYIN’

Looks like I bought the lows and am having a barrel of fun. 17 pts and holding a trailer. Numbers work. Robert V.

I waited patiently for the spy 433.25 and was paid handsomely. Thanks for all you do! Dirk R.

COMMON SENSE MARKET STUFF EVERY DAY

DISCLAIMER STUFF: Nothing found in this communication is financial advice. This newsletter is strictly educational and not intended for or should be thought of as investment advice or a solicitation to buy or sell any assets or to make any financial decisions whatsoever. Please be careful and always do your own homework.