- OnTheDocket

- Posts

- Can You Find Diamonds In The Junk Pile?

Can You Find Diamonds In The Junk Pile?

⚾PRE GAME WARMUP

It's turnaround Tuesday...

Markets are in the midst of the aforementioned and inevitable squeeze operation. The overnight crew did some "eating time off the clock" before pushing higher in the wee hours. Remember, we've got the neckline of the widely talked about head and shoulders pattern.

Can they do it today?

The first order of business for the bulls is to stay above Member login, which will be our early pivot. This keeps the door open for some "unfinished business just a little higher. The higher they go, the more the magnet will pull price toward the neckline...

The next price up north comes in around Member login. Above will be handled in our real time format as and if needed...

The flip side is getting below the pivot which opens the door for a drop toward Member login. Below will be handled on an as and if needed basis...

We’re lookin’ for the “Morning Trade.” We don’t care whether it’s a short or long, provided we get paid…

🎬THINK IN PICTURES

Let’s talk Junk.

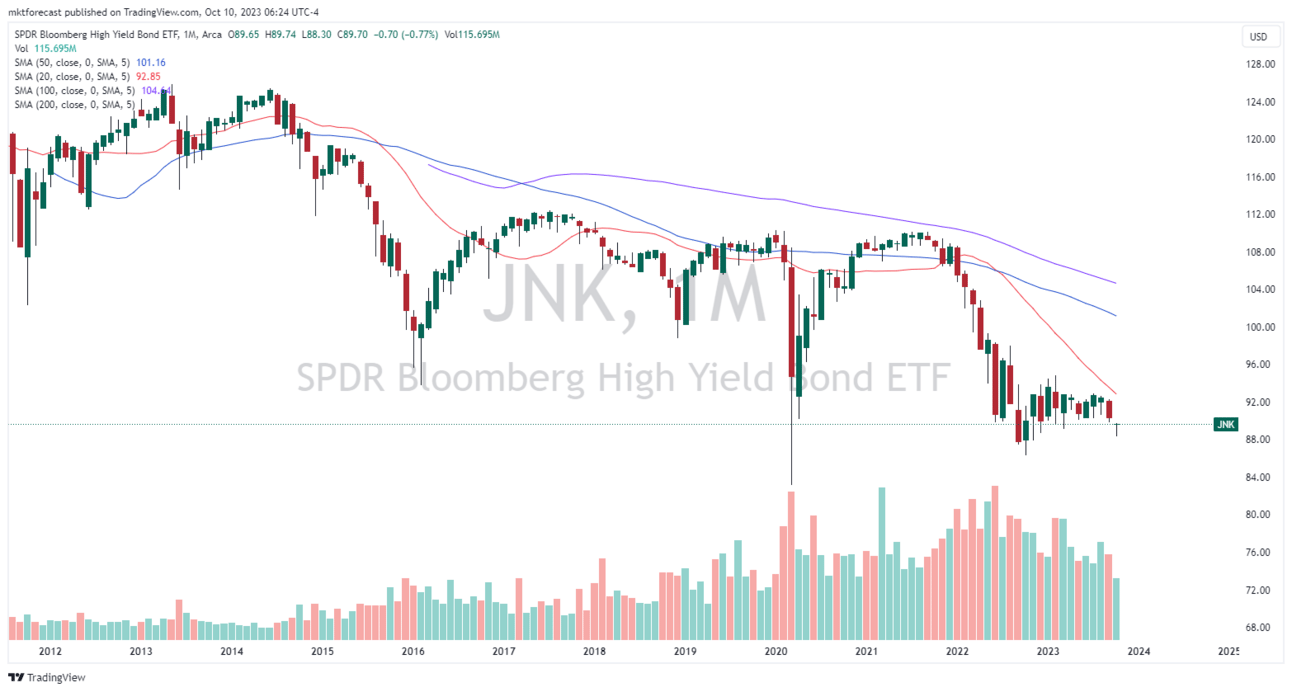

The chart below is JNK which is one of the exchange traded tracking funds for high yield debt.

The allure has always been the high dividend and diversification. After all, the average investor doesn’t have the knowledge to be purchasing high yield, high risk bonds on their own. It takes a lot of research, diligence and experience to be in the that business…

What does the chart say and how do we interpret it? It’s a weekly chart which gives us a long term view. She’s below all her moving averages and we know what that means… The trend is your friend until she throws your stuff out the window. Also making a bearish flagish pattern. Until she “breaks the chain,” the chart says lower prices are coming.

Bonds trade inverse to interest rates. Rates up, bonds down. High yield bonds or Junk bonds as their called in the biz are Uber sensitive. Why?

Because the companies that are classified as junk bonds are the one’s who had trouble borrowing money in the first place. They’re high risk for the investor, so we want to be paid extra for lending money.

Take high risk company “A” who borrowed money 5 years ago when rates were near zero. They issued [junk] bonds at 7.5% yield back then. What happens now that rates have risen from a joke to near 5% on the 10 year treasury bond?

It’s simple, the borrower who needs to refinance, roll over or issue new debt to keep the band playing on and their company solvent, can’t afford it. The cost is too high and therefore, here come the hard decisions…

Pretty straight forward stuff. The interpretation of the chart is pain ahead in the form of bankruptcy’s, liquidations and pink slips.

🌗RECYCLE TIN FOIL HAT

We’re watching to see if markets trade up or down into the Annual Solar Eclipse this coming weekend.

The event will turn the Sun into a spectacular ‘ring of fire’.

The effects of these events can occur a couple of days before or after the actual thing…

What effects? They can cause a short term shift in markets also known as a reversal…

Share OnTheDocket

You currently have 0 referrals, only 5 away from receiving Free Month InsideTheNumbers LIVE.

💣WRECKONOMICS

If bitcoin was going to be the replacement for currency and the future of financial exchange, why are central banks buying gold?

Pretty good question, don’t ya think?

Maybe they’re diversifying away from the US Dollar. We’ve discussed this in the LIVE Room many times. The demise of the dollar will come when the world no longer recognizes the Dixie as a reserve currency and begins trading in alternatives.

While gold is not the likely candidate to become a currency of choice, it appears many countries are headed back toward the roots of having a vault full of real tangible value to back a “future” currency…

When the Fed buys bonds, investors follow. When they sell bonds, investors follow.

Are they following the yellow brick road?

🩺PSYCH WARD

Are you addicted to trading? What are some signs and signals that will give you awareness?

You take random increased risk such as bigger “bets” in order to experience excitement. It’s not like the trade setup was so good that it warranted a larger position size, you do it on a whim…

You are obsessed with research, chart analysis, fundamental analysis and any other made up analysis to convince yourself “you’re working” and the results will follow.

You’ve lost interest in other hobbies or activities you used to enjoy, nothing gives you as much satisfaction as being in a trade (more than winning a trade)

You trade compulsively and experience cravings, you don’t even like the weekends because the market is closed. Not to mention waking up in the middle of the night to check the futures.

Are you lying about or hiding your trading volume and results from loved ones?

You take loans, sell stuff or use money ear marked for household necessities in order to continue trading.

You continue to trade even when your financial stability, relationships or physical and mental wellbeing are suffering.

The foundation of trading is based on process and mechanics. It’s a rinse and repeat of what works from a probability standpoint.

🏆MEMBERS SAYIN’

It’s hard to believe all the stuff I didn’t know before I found David. Jared L.

Keeping us out of trouble is like the unsung hero some days, thanks Dave. Mike M.

COMMON SENSE MARKET STUFF EVERY DAY

DISCLAIMER STUFF: Nothing found in this communication is financial advice. This newsletter is strictly educational and not intended for or should be thought of as investment advice or a solicitation to buy or sell any assets or to make any financial decisions whatsoever. Please be careful and always do your own homework.