- OnTheDocket

- Posts

- A Different Kind of Trading Bias You Weren't Aware of

A Different Kind of Trading Bias You Weren't Aware of

⚾PRE GAME WARMUP

It's hump day already...

Another overnight team on a pull back operation, talk about a two way tape this week...

We'll start with the big picture. There's an open gap down below. They didn't go get it done yesterday which leaves "unfinished business."

Here are the progression of events. [Login here] is an important number. Getting below and staying below opens the door for yesterdays lows, which is also now the gateway to the gap at 431.55. Sometimes they come up short, other times they spike em' through. The spike em' through place is [Login here] give or take...

As a just in caser, let’s not forget the magnetism down around [Login here] give or take…

The flip side situation is giving the bulls a B-12 shot and getting them back above 435.00 for starters. And the "back to bull" case is above 436.00, same as yesterday.

🎬THINK IN PICTURES

This one takes the cake. Here’s a fund manager explaining what everyone missed and what’s going to happen next.

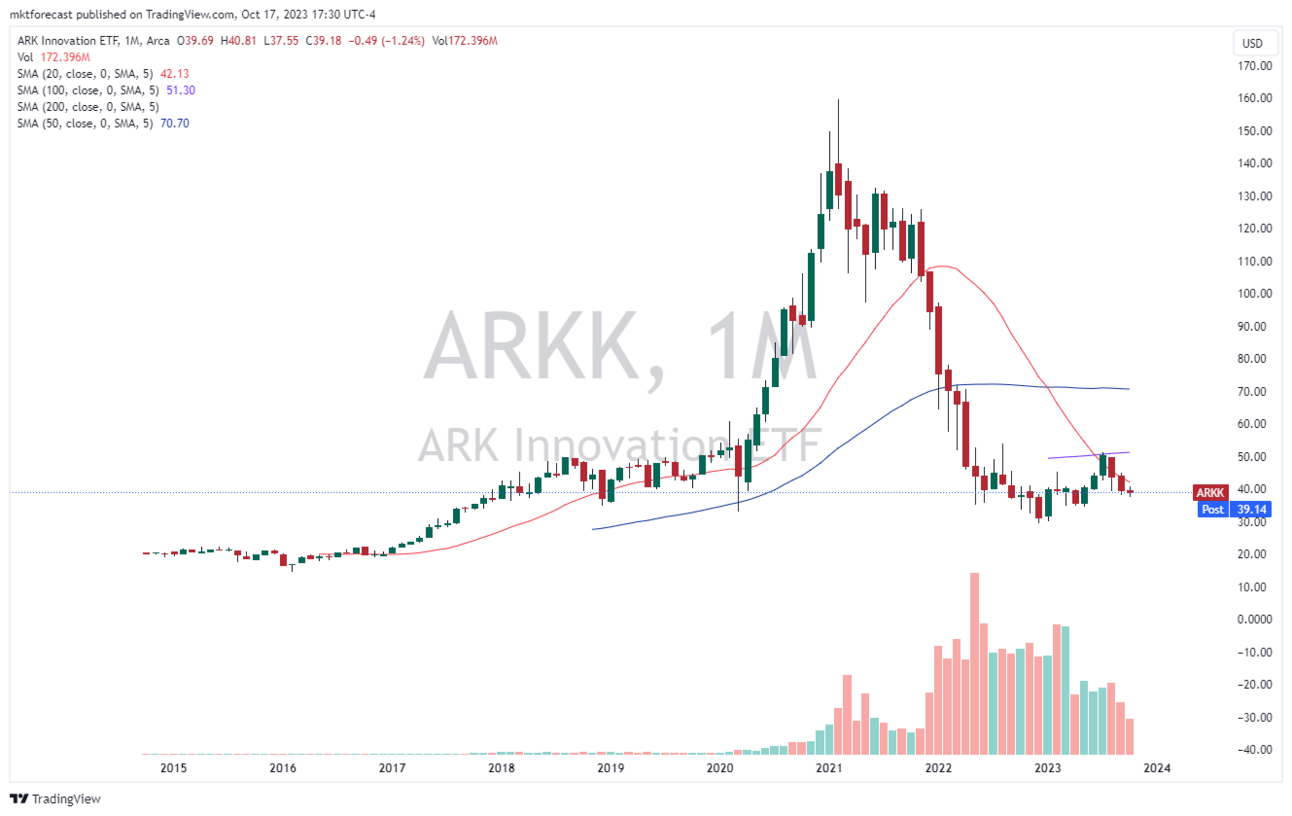

Let’s take a look at her fund and see if she knows what she’s talking about. What you see is a monthly chart of ARKK, the flagship fund run by Cathie Wood. She did great in the bull market, but what sets money mangers, traders and investors apart is how they do in a bear market phase. All she did was make excuses and predictions that were wrong the whole way down.

Should we listen now?

Share OnTheDocket

You currently have 0 referrals, only 5 away from receiving Free Month InsideTheNumbers LIVE.

💣RECKONOMICS

Here’s a case where you must think in reverse to understand. The argument is being made where lower cash balance in bank accounts are good for the US economy.

We know the growth engine of the economy is the consumer who accounts for almost 70% of total consumption. What they’re saying is that bank balances are down around or less than same level as the pre pandemic era.

It’s a zero sum game. Money out of bank accounts equals money in to other places such as the general economy which helps fuel the GDP. Works for now.

Isn’t that short sighted? If the trend is your friend, and the trend of a bank balance is headed from upper left to lower right, doesn’t it get to the point where there’s nothing left and spending has to “pull back” or stop altogether?

It’s a simple case of finding something that appears to be a positive today, using it as an excuse to bolster sentiment in an obscure way with no regard for what happens next. After all, what’s the plan for a new cycle of spending once the bank accounts get close to or below zero?

More credit card debt that won’t be paid back?

🩺PSYCH WARD

We talk about confirmation bias quite often. In simple terms, it’s looking for information to support your position or feeling about the market without being the umpire, calling balls and strikes. It’s like “talking your book.”

What about Anchor Bias?

Let’s say you buy a stock at $50 per share and of course it immediately goes down. Familiar? The normal thoughts occur such as “just get me back to even” or “maybe I’ll buy more to average down.”

You’re watching every move, focused on the $50 cost basis because that’s what’s important to you. What most don’t realize is Mrs. Market has no idea, nor does she care what your buy price was. The stock is going to do what it’s going to do regardless of where your number is. Our mind is anchored to $50 rather than the current chart and price action.

Traders and investors tend to lose sight of reality in what the chart is saying because they stay focused (or anchored) on the $50 and resort to hopium over reality.

Stops are no different, in fact can be worse. Many traders select an arbitrary stop based on the amount of money they’re willing to risk. What happens if your stop is right above the next support price or “important number?” Simple, you get stopped out, the market hits the number below and begins it’s ride back up north. You were the last one out.

Once again, being anchored to a stop is arbitrary, the numbers are not. A stop must be in relation to an important place on the chart that makes the trade wrong, your two point stop likely won’t do the trick.

Ever wonder why you get stopped out constantly, right before the thing reverses back in the other direction?

🏆MEMBERS SAYIN’

I’ve watched your videos for several years and have been a subscriber to InsideTheNumbers. It’s hard to believe what I didn’t know before, even though I though it did. Thank you! Mark O.

COMMON SENSE MARKET STUFF EVERY DAY

DISCLAIMER STUFF: Nothing found in this communication is financial advice. This newsletter is strictly educational and not intended for or should be thought of as investment advice or a solicitation to buy or sell any assets or to make any financial decisions whatsoever. Please be careful and always do your own homework.