- OnTheDocket

- Posts

- If US bonds are downgraded again...

If US bonds are downgraded again...

⚾PRE GAME WARMUP

Happy Thursday...

They've been making one of those bullish eating time off the clock patterns all night long. For about two week, each time the market tried to stage a rally, she was met with relentless selling, quickly knocking price right back down...

Some day soon they'll break the chain of lower lows, is today the day? We don't know until we know, so we start with the numbers and take it one candle at a time...

Above yesterday's closing price of 426.00, the door begins to open for the push up toward Login Here which is now unfinished business...

Above on candle closes opens the door for another leg higher which will be posted in a real time type formation...

The flip side bear case is getting below 426.00 which opens the doorway for a leg lower to at least run a test of Login Here or lower...

The or lower part will be provided in an as and if needed type situation...

🎬THINK IN PICTURES

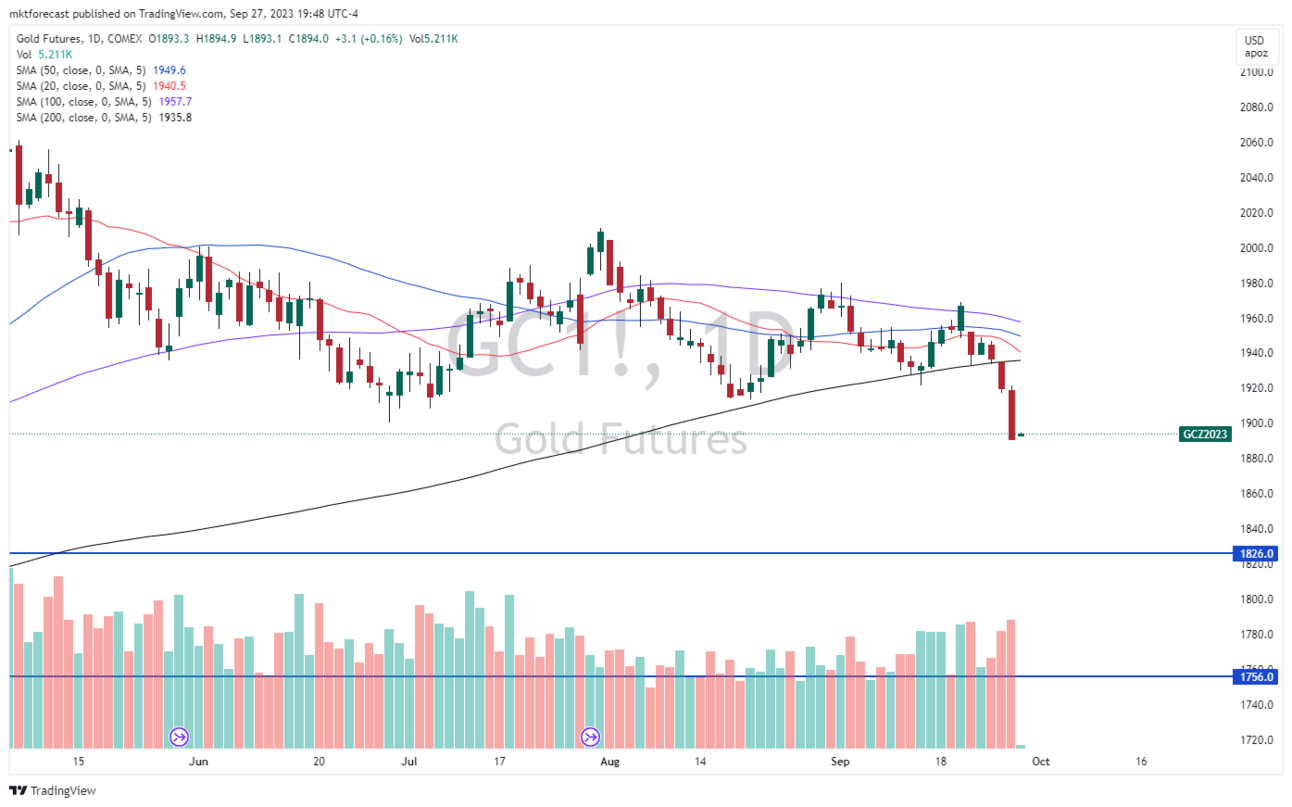

Precious metals have been sent out for polishing.

Where is that next big time support area for Gold? (GC Futures Chart)

We’ve got the next number where the market can find support and stage a rally. She comes in around 1826.

🌗RECYCLE TIN FOIL HAT

The hats are lined up for the whole 60 day, 666 thing from last nights video. It’s one of those awareness things.

Supermoons are full moons that occur when she’s closest to the Earth in her orbit. This one also has the moniker of Harvest Moon.

If the moon phases affect people, and people are the market, it only makes logical sense that shifts in direction, sentiment and velocity can occur around these events.

Hard concept to wrap your head around if you don’t have a tin foil hat in your basement or attic…

Share OnTheDocket

You currently have 0 referrals, only 5 away from receiving Free Month InsideTheNumbers LIVE.

Or copy and paste this link to others: https://onthedocket.mystrategicforecast.com/subscribe?ref=PLACEHOLDER

💣WRECKONOMICS

The entire world knows about the $33 Trillion in US debt. Everyone who knows, knows it will NEVER be paid off…

How the self dealing geniuses in Washington DC choose to screw holders of dollars in the future is an unknown. The known known is that holders will be screwed.

Here comes one of the most famous rating agencies in the world showing up to the party, having no idea it’s been over for quite some time…

Right at the eleventh hour along with Congress who will either toss a last minute Hail Mary to extend the “never to be paid” debt ceiling, or shut down the most bloated bureaucratic giant squid the world has ever seen - for a couple of weeks…

Do you think the suites from the Biden administration paid a visit to S&P and Moody’s, hat in hand with vale threats about downgrading the US credit rating?

🩺PSYCH WARD

What’s the main reason why price comes up short of a gap and trades away?

First, we must realize the market is controlled by an outfit called Trick & Co. Also known in trading circles as the Trick, Trap, Fool and Frustrate Crew. Their job is make as many traders and investors look like fools as much as possible.

Now that we have a foundational understanding…

The market is headed directly toward a gap which sets off alarm bells in the control center at Trick & Co. headquarters. They know it’s an opportunity to screw two different groups of people.

First are the traders waiting to exit a trade after riding Mrs. Market to a gap. The other are the poor souls who are about to be left standing at the alter waiting to enter a trade at the same gap…

Both sets end of chasing the tape. One chases the exit watching profits erode and the other chases the market after missing the gap, only to get whipped out because they have no idea what’s happening and entered the market on pure FOMO…

Moral of the story, we sell positions into strength of the market without waiting for price to reach the final final number…

🏆MEMBERS SAYIN’

Anyone that doesn't understand the value of your analysis, really shouldn't be trading at all. Joseph K.

COMMON SENSE MARKET STUFF EVERY DAY

DISCLAIMER STUFF: Nothing found in this communication is financial advice. This newsletter is strictly educational and not intended for or should be thought of as investment advice or a solicitation to buy or sell any assets or to make any financial decisions whatsoever. Please be careful and always do your own homework.