- OnTheDocket

- Posts

- The Tail That Wags The Economic Conversation

The Tail That Wags The Economic Conversation

⚾PRE GAME WARMUP

It's hump day already...

The overnight crew hung around ES 4400, the big phat numbers house. We've got some dater before the bell which can "move the tape.” Today is PPI day, part of the economic alphabet soup…

The big picture is still the "neckline." Can she stay above or is getting below and staying below the thing today?

We'll use [Member Login] is the early pivot.

Above and the door opens up for a leg higher to[Member Login], then to the highs from yesterday and beyond. The beyond part will be posted as and if needed, dater dependent...

The flip side has Mrs. Market falling below the pivot which opens the door for a leg lower to 433.25, and lower. The lower stuff will be handled in a real time format as and if needed.

🎬THINK IN PICTURES

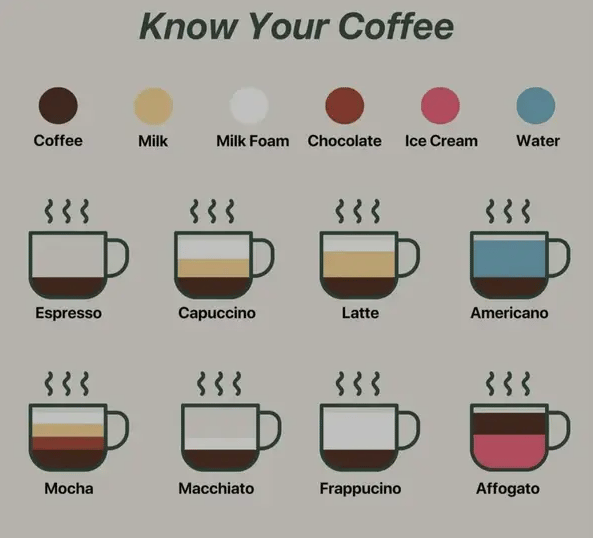

Most traders start their day with a cup or two of Java. Does anyone even understand all the fancy options available outside of “just coffee?”

We think better in pictures and charts always tell a story.

🌗RECYCLE TIN FOIL HAT

Let’s belabor the point a little more…

Share OnTheDocket

You currently have 0 referrals, only 5 away from receiving Free Month InsideTheNumbers LIVE.

💣WRECKONOMICS

We know the market is the driver of conversation. Stock prices up, the discussion centers around soft landing, mild to no recession, a fantastic 2024 and so on…

Hold on. The Fed has said that we should expect the process of slowing inflation by deliquefying markets to include pain. Have we seen the pain yet? Have they cleaned out enough excesses in system?

What about the real estate market? Aren’t we pretty close to prices that were just in the stratosphere driven by bidding wars galore?

We’ve seen this before. It’s human nature to believe because certain prices have come off highs, markets pulled back and rates have risen to twenty year highs that we must be close to finished.

But what about the pain? Have we seen job loss, [more] sudden bank failures and fire sales of assets yet? Isn’t that part of the pain conversation?

All we have to do is go back to any and all of the bear markets for reference. Take the tech wreck of 2000 or the financial crisis of 2008 just to name a couple. If you follow the pain road map, we’re not done yet.

As part of a true blue bear market phase, at times, they make it look like things are just fine. We have tremendous rallies designed to suck in the FOMO players who are told “stocks are cheap.”

Another rug pull event ensues, driving prices to lower lows. On the way down, the conversation immediately changes from recovery and soft landing, back to recession, crash and all the other stuff on the wall of worry they can find.

The market is the tail and the economy, economists, pundits, analysts and financial product salesman are the dogs…

🩺PSYCH WARD

What should your daily monetary trading goal be?

Let’s start with Mrs. Market. She’s not in the business of sending memo’s about the type of day or market we’re about to enter. Sometimes she’s wild and crazy with tons of volatility and other days she’s content in a small range called a chop shop formation.

First we should agree that traders need a certain level of volatility slash price movement to participate. So right off the bat, we know quiet days have less opportunity and therefore less chances to make money. On the flip side, wild and crazy rodeo days carry a lot of risk and therefore must be treated as such in terms of position size and management of said risk.

Are we expected to have the same daily goal on both these type of days? “Hmmmm, good question, “haven’t thought about that one”, he says…

Next up, the losing trade. Let’s say you lose $500 on the first trade of the day. You have a $500 daily goal, now what? We’ll we now have to make up the first five bills and then find a way to reach the daily goal.

Once we’re in this position, bad decisions come in rapid fire fashion. Now we’re under the gun, so we quickly look for “another trade.” In the process, we conveniently forget all the important things we learned about when and why to take a trade, we’re focused on just getting in another trade to get our money back.

Our mind plays devilish tricks and helps us quickly find reasons to justify trades, calculating the profit even before we enter the order.

Is it necessary to go on? We know what happens next, we lose, begin revenge trading over and over until we’ve soon realized “we did it again, just lost another $2,500 in 5 hours.

The root cause in this case, daily goal…

We take what Mrs. Market has to offer each and every day.

🏆MEMBERS SAYIN’

Just wanted to say thanks for doing what you do every day. There’s no way I could do this without the numbers. John K.

I took a total of 29 trades in September, 26 were wins. Of the 3 losses, 2 were my own guesses and they didn’t work. Brian C.

COMMON SENSE MARKET STUFF EVERY DAY

DISCLAIMER STUFF: Nothing found in this communication is financial advice. This newsletter is strictly educational and not intended for or should be thought of as investment advice or a solicitation to buy or sell any assets or to make any financial decisions whatsoever. Please be careful and always do your own homework.