- OnTheDocket

- Posts

- Stock Market Getting Stretched to the Snapping Point

Stock Market Getting Stretched to the Snapping Point

⚾PRE GAME WARMUP

Happy Friday...

Another pull back overnight, we all know the news items and Mrs. Market is agitated. We'll start with the downside stuff. [Login Here] is an important place where a bull bear battle should ensue.

Getting below and staying below opens the door for another leg down which will be posted as and if needed in a real time type formation...

The flip side situation is getting above [Login Here] which opens the door for a rally attempt and another leg higher, which will be handled in a real time format as and if needed...

The big picture is she’s getting close to the rubber band breaking situation where the early October lows come into view…

🎬THINK IN PICTURES

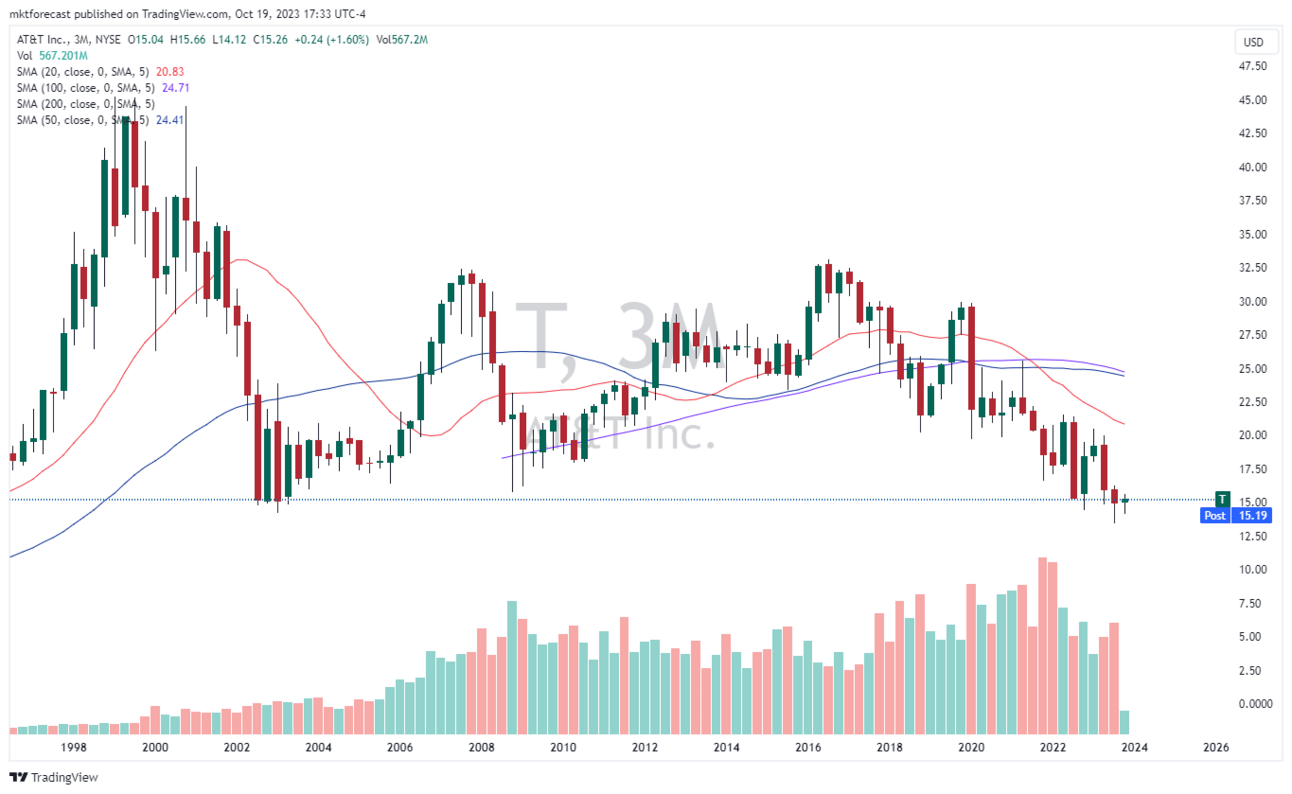

Don’t fall for the dividend trap. They’ll tell you, “hey, look at the great dividend on XYZ company. Get paid to wait.

The dividends are rich because the stock price is down, and likely down for a reason. Companies with steady cash flow tend to pay good dividends. However, many of the companies with steady cash flow also have heavy debt loads such as AT&T, Verizon and most of the public utility companies.

The more debt, the more it costs to service it. The more it costs, the less they make. The less they make, the lower the stock price goes and the more likely they are to cut said dividend.

AT&T at 20 year lows. Can it go lower?

Share OnTheDocket

You currently have 0 referrals, only 5 away from receiving Free Month InsideTheNumbers LIVE.

💣RECKONOMICS

There’s no point in linking an article for todays topic, they’re too ridiculous. Just look at the headlines following Jerry’s speech yesterday. They read like a contradiction machine.

Powell warns of more rate hikes.

Powell signals November pause.

Fed Chair Powell hints that soaring bond yields could mean end of rate hikes.

And the found on the CNBC/economy website was removed, it was to preposterous.

What’s an investor supposed to think or do about it? Nothing is the short answer.

The market already knows about rates. It certainly won’t like higher rates, but even a week ago stocks were a lot higher and rates aren’t that much different? It’s a known known IMHO.

There’s no need to look for reasons or excuses why price is moving, we simply use all the things right there on the charts to tell us, trend, support, resistance, important numbers and places for specific reasons that repeat over and over. Get the point.

Let the talking heads turn blue in the face bantering back and forth at each other, with little to no knowledge of what’s actually happening.

Below an important price, the door opens for another. Above an important price, the door opens for another.

This happens on intraday charts as well as long term charts. Just look at the performance at specific numbers from InsideTheNumbers.

It’s not easy, but it’s that simple.

🩺PSYCH WARD

Don’t use your number for a profit target, Mrs. Market doesn’t know or care about it…

We’re talking about a profit number. How many times has this happened?

You’re in a trade and it’s going well. Price is rising and you’re looking to take an exit. You put the order in at a number that happens to coincide with the dollar amount you would like to book as profits, let’s say $1,000.

Do we even have to discuss the rest? Price comes within a few cents of the exit and begins to pull back. You figure, “I’ll just wait for the next push and the trade will execute.”

While you’re waiting, price keeps falling. Now you’re mind changes from the calmness of where you’re going to spend the profits to oh no, now I’m only up $500 and it’s falling.

Now you’re worried about losing the rest of the profit you have left so a stop goes in that will at least salvage $300 on the trade, worst case.

Next scene shows price coming right for your stop, they take it and head immediately back up. Another botched trade.

This one had two errors on the same play. First, you set the exit at your profit number rather than Mrs. Markets resistance number. She doesn’t know about yours, nor does she care where it is. We take what the market gives each and every day.

The second mistake was putting a stop in the system which shows the market where your order is, allowing the computers to “come and get it.” Yes, this happens all the time…

We sell into strength on the way up at or before the next resistance area, regardless of how much profit is on the table. It’s how we run it as a business…

🏆MEMBERS SAYIN’

Hey David! I Just wanted to thank you for the in the docket Mails. They are so helpful! @roflmaorolf

It was a chop shop this morning, and you kept the room steady and making money. Thank you, David! Jory J.

COMMON SENSE MARKET STUFF EVERY DAY

DISCLAIMER STUFF: Nothing found in this communication is financial advice. This newsletter is strictly educational and not intended for or should be thought of as investment advice or a solicitation to buy or sell any assets or to make any financial decisions whatsoever. Please be careful and always do your own homework.