- OnTheDocket

- Posts

- Little Known Crash Cycle You Should Know About

Little Known Crash Cycle You Should Know About

⚾PRE GAME WARMUP

It's the anniversary of the 1987 stock market crash...

Happy Thursday. Another drop and and bounce back sponsored by the overnight crew. The tape is weak, they can fall further or begin a snap back operation from anywhere. Remember, it's options expiration week where weird stuff happens.

During bear phases, they have a rip your face off rally’s from anywhere - we've even seen a few mini ones already this week...

Let's start with the bear case. Mrs. Market left some unfinished business hangin' yesterday. The spot is [Login Here] and just below is another important number around [Login Here]. Below on candle closes opens the door for another leg lower, which will be posted in a real time situation as and if needed.

The flip side bull case is getting above and staying above [Login Here] which opens the door for a visit and test of 432.00. Pushing above and staying above opens the door for the next leg higher which will be handled as and if needed.

🎬THINK IN PICTURES

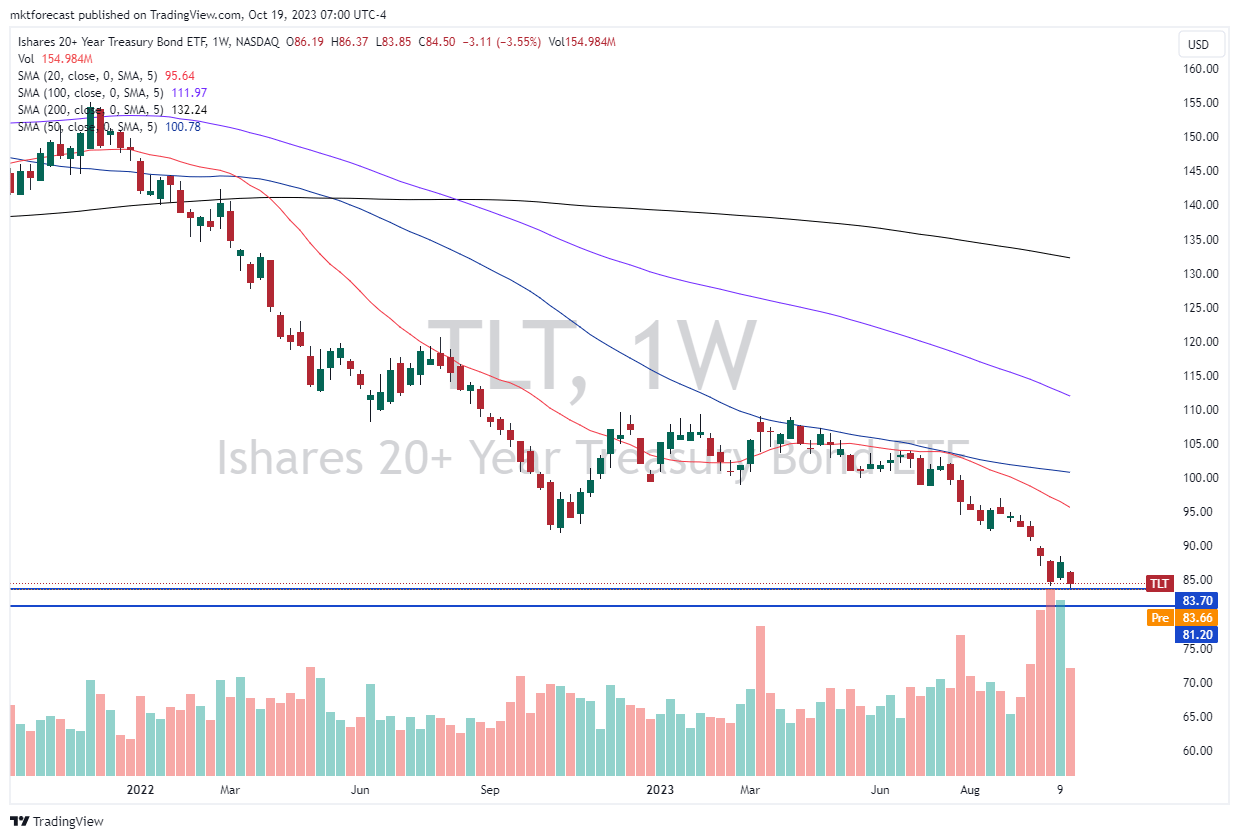

The chart below is TLT which is an exchange traded fund that tracks the twenty to thirty year treasury bond price. It works the inverse of yields.

Traders in the LIVE Trading Room have been watching and waiting for them to satisfy an important number down at 83.70. They did it in the pre market a few weeks ago, but never during the regular session.

Today they’re paying another visit. Closing the week above or below will be a “tell” of what’s to come for the bond market, interest rates and everything that’s sensitive around them…

🌗RECYCLE TIN FOIL HAT

36 years ago today was the 1987 stock market crash. October 19, 1987.

This doesn’t mean the market will crash, but we’re always on guard as the date is ominous each and every year…

Share OnTheDocket

You currently have 0 referrals, only 5 away from receiving Free Month InsideTheNumbers LIVE.

💣RECKONOMICS

Courtesy of Mark B. from the LIVE Trading Room. We learn from each other, nobody has the patent on all the good information.

1929 – The Philadelphia Athletics win the World Series, the same year as the worst stock market collapse in U.S. history.

1930 – The Philadelphia Athletics repeat. World is in the Great Depression.

1980 – The Philadelphia Phillies win and America’s economy hits the worst recession since the World War 2 era.

2008 – The Philadelphia Phillies win again. And we all know what happened here – the “Great Financial Crisis, Housing Bubble and more…”

2023 – ???

🩺PSYCH WARD

The only two emotions in trading and investing that matter are fear and greed. Everything else is a fractal of one or the other…

Yesterdays market and LIVE Trading Room was a great example of how we eliminate the greed factor.

We had two very specific trades on the table. Before we buy a single share or contract we know where the entry is and why. We know where the trade is wrong. We know the next place the market would go if wrong. We know the first exit allowing us to put a “base hit” in our pocket. We know the subsequent resistance areas allowing us to take more profit.

We keep the trade as a process and treat it mechanically, allowing us to take emotions out of the mix.

What happens when you’re in a trade, take profit at a specific pre determined place on a portion of the position and then let the remainder ride for the “never know” or possible rocket ride, whopper or home run?

You’ve turned the thing into a risk free emotionless trade where the cost of holding the remainder is zero. The only requirement from that point forward is not to let the remaining portion of the trade go bad on you…

The morning trade is our bread and butter…

🏆MEMBERS SAYIN’

You saved me from taking that bad short early in the day, and I caught a box of ziti on the way up. Thank you, David! Jory J.

90% gains from money traded today. Kenny W.

COMMON SENSE MARKET STUFF EVERY DAY

DISCLAIMER STUFF: Nothing found in this communication is financial advice. This newsletter is strictly educational and not intended for or should be thought of as investment advice or a solicitation to buy or sell any assets or to make any financial decisions whatsoever. Please be careful and always do your own homework.