- OnTheDocket

- Posts

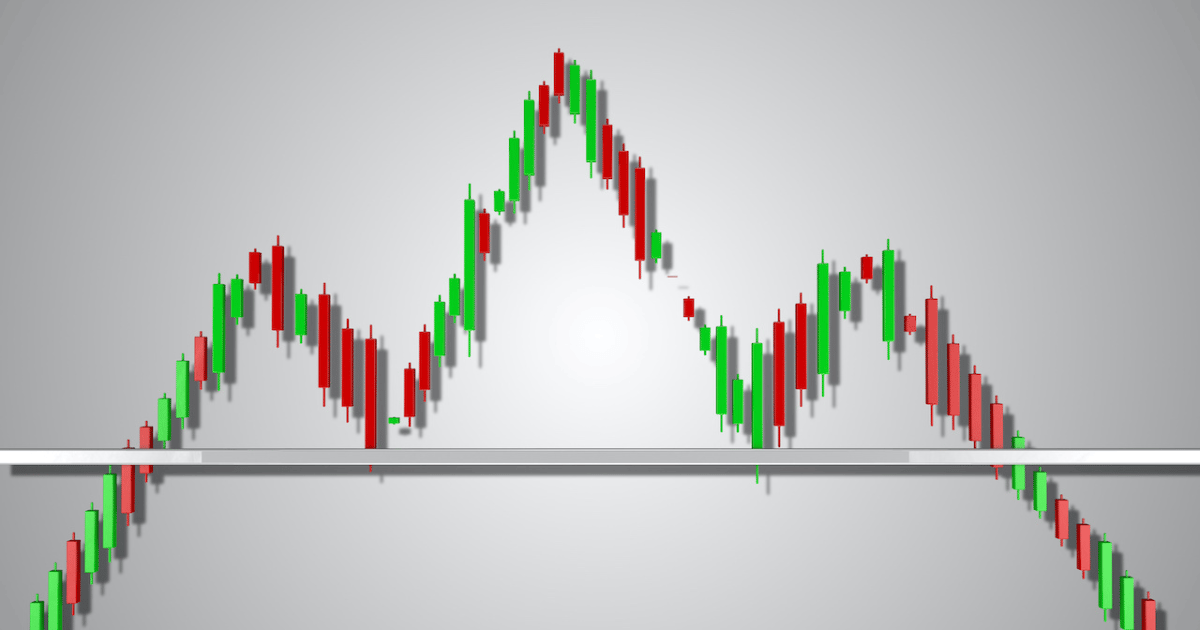

- Another H&S Neckline Test?

Another H&S Neckline Test?

⚾PRE GAME WARMUP

The overnight crew tried to bounce the tape, but instead put in one of those bearish flagish patterns that began leaking lower before sunrise...

The big bear picture is staying below the neckline of the head and shoulders pattern... (above SPY 434.00). The next [short term] destination down south is the big phat round number of 430.00 which was reached into the close on Friday when nobody was looking...

Below begins to open the door for another leg lower taking Ms. Market down to spike [Member Login]. Any more selling will be handled in real time as and if needed...

What about the flip side known as a rescue operation? The bulls would have to recapture [Member Login] on candle closes to get anything going. Let's say they did and a mini squeeze gets going. They would want to run a test of [Member Login] or more...

Volatility is a traders best friend…

🎬THINK IN PICTURES

This is the exact thing discussed last week. The horizontal trend line represents the neckline of the Head & Shoulders pattern.

On Friday, Mrs. Market ran a back test only to be rejected from the “underside” of the widely touted pattern, finishing below for the second day in a row. There is an active target to completion much lower, provided she doesn’t “recapture” the neckline on daily closing price…

🌓RECYCLE TIN FOIL HAT

Over the weekend we had one of our “Tin Foil Hat” events, the Autumn Equinox.

There’s no hard and fast rule markets will reverse (or accelerate), but she’s been know to do either or in the past.

We can certainly make the case she traded down right into the event, so we’re on guard…

It’s an awareness situation, the Sun is exactly above the Equator where day and night are equal in length; either of the two points in the sky where the ecliptic (Sun’s annual pathway) and the celestial equator intersect.

This event marks the beginning of autumn, a seasonal change.

Have you ever heard of “seasonality” in markets? Here’s a new twist.

Share OnTheDocket

You currently have 0 referrals, only 5 away from receiving Free Month InsideTheNumbers LIVE.

Or copy and paste this link to others: https://onthedocket.mystrategicforecast.com/subscribe?ref=PLACEHOLDER

💣WRECKONOMICS

The Government has a great program for consumers. They flood the system with liquidity, also called “Money” to stimulate the economy.

The effects are found in low interest rates creating artificially low and affordable assets for the everyday consumer. Nice guys over at the Fed…

Even though countless smart people pounded the table for years about the “coming inflation,” nobody in Washington or Wall Street cared - party on…

They continued priming the pump until “out of nowhere,” and much to the surprise of the geniuses at the Fed, prices of all kinds of stuff started to rise setting off alarm bells in the halls of gov’t…

Swift action was taken to rapidly raise interest rates to “cool off” a hot economic run…

Now it’s time to crush the little guys and gals (most everyone) who spend a big percentage of their monthly income in credit card, mortgage and car payments - that are now rising.

Not to mention the cost of food and fuel which mysteriously is left out of “core inflation” measurement they tell us about. Even though those two things are the core of everyday life…

It’s a good thing the Fed came in to solve the problem they created…

🩺PSYCH WARD

Having a daily $$ trading goal can be hazardous to your wealth.

Let’s say your having a nice day where you’re close to the daily goal. You’d like to get there, so just one more quick trade will do the trick.

Here’s where things already went off the rails…

Without realizing it, you’re now in “justify the trade” mode.

Traders have no patience, so as they begin looking for “The Next Trade,” and unaware they’re doing it…

They start calculating how much the stock has to move * amount of shares willing to purchase.

It’s moving up, so we better make a quick decision or “we’ll miss it…”

Now we’re chasing a daily goal rather than entering a trade for the right reason, at the correct price…

The rest is by the book. You’re the last one in, the next tick is down and within minutes we’ve now given back half of the days gains…

And the bad decisions based on emotions begin…

🏆MEMBERS SAYIN’

Stuff like…

“I’ve been trading for 30 years (about 10 running a large fund) and you are the best technician I’ve ever worked with. You’re ability to adapt is refreshing.” Jason L.

COMMON SENSE MARKET STUFF EVERY DAY

DISCLAIMER STUFF: Nothing found in this communication is financial advice. This newsletter is strictly educational and not intended for or should be thought of as investment advice or a solicitation to buy or sell any assets or to make any financial decisions whatsoever. Please be careful and always do your own homework.