- OnTheDocket

- Posts

- Why The Fed Will Be Flying Blind

Why The Fed Will Be Flying Blind

⚾PRE GAME WARMUP

Let’s go back to the last couple of videos. We were discussing how it’s not out of the question for Mrs. Market to run a test of the neckline of the head and shoulders pattern everyone is watching…

At least in the pre market, they’re bouncing again and hovering around the next SPY big phat round number of 430. Several LIVE room members shorted around this area yesterday and were paid accordingly.

Above 430.00 the door opens for another leg higher toward Login Here give or take…

If they keep going and get above, guess what?

The trendline above Login Here give or take starts to draw price in… We don’t know they will or can get there, but the awareness of what’s up there is important to stay balanced…

What’s more? In last night video we discussed last months low around 433.00. You see where I’m going with this, there’s a lot of reasons Mrs. Market would try and get up there over the next few sessions - or sooner…

What about the bear case, like if they fail and kill the tape again?

426.25 give or take is a support area if they get below yesterday’s close [The Flat Line]. As a just in caser, getting below that on candle closes would then open the doorway for another leg lower down to 424.50 give or take….

🎬THINK IN PICTURES

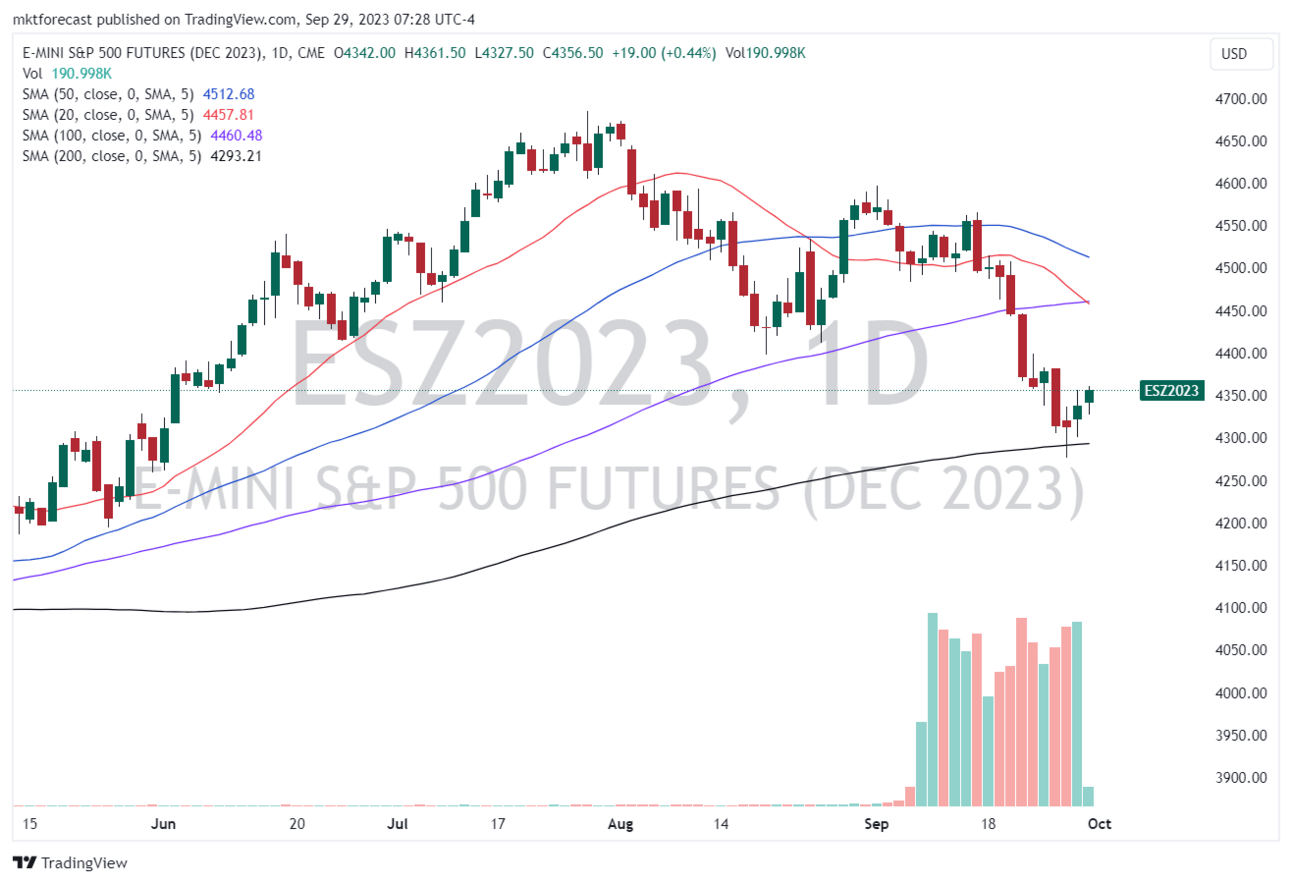

Which chart are you looking at? Below is a daily chart of the ES Futures contract. You’ll notice the hit, spike and bounce off the 200 period moving average. Many traders were watch the SPX (cash index) or the SPY (ETF tracking stock), and neither came close to their moving average.

Who’s right? This is a great example of why we look at all charts, all time frames to get a clear picture of where markets are.

Just to add another dimension of things - the bounce back wasn’t just at the moving average, but at one of our big phat round numbers… Does the bounce back make more sense now?

🌗RECYCLE TIN FOIL HAT

Just before 6:00 AM EST is the harvest moon slash supermoon.

The debt ceiling debate is front and center on the last day, at the eleventh hour once again for the second dozen time…

Let’s not forget about the newly reported possible US credit rating downgrade.

Share OnTheDocket

You currently have 0 referrals, only 5 away from receiving Free Month InsideTheNumbers LIVE.

Or copy and paste this link to others: https://onthedocket.mystrategicforecast.com/subscribe?ref=PLACEHOLDER

💣WRECKONOMICS

Sometimes you can’t make this stuff up with a team of writers fresh off a picket line. We’ve got a government shutdown looming. Prevailing wisdom says “good”, shut down the gov’t credit card let the dust settle. We probably don’t need two thirds of the bureaucracy anyway.

But wait, there’s more…

Enter, the Federal Reserve who is driving the interest rate bus down a narrow lane on the road to recession.

How does the Fed make their decisions? As Jerry and all other FOMC participants will tell you, “we’ll be dater dependent.”

Sounds legit from the outside looking in. The lion share of data is made up out of whole cloth using formula’s only Matt Damon in Good Wil Hunting could solve. Where does it come from? The very Government agencies that will be closed for business during the shutdown operation…

The person (Jerome Powell) the entire country and a large part of the developed world is depending on to navigate the economy will be flying blind without the dater to make informed decisions…

What will Jerry do?

🩺PSYCH WARD

Information overload can be a traders nightmare.

We watch YouTube videos, read blogs and watch Tout TV (CNBC) to get the latest “state of the market” so we can put on a trade that will pay us for being right.

It starts out with “I’m bearish, so let’s look for some videos that have crash in the title.” There are plenty to chose from and after watching two or three, it’s settled, we’re going to be short.

Next scene shows the futures up, their talking soft landing on TV, stocks are cheap and this could be the end of the correction, they say…

That can’t be true, look at all the bricks in the “wall of worry,” there are countless reason why markets should crash right now…

New thought, “maybe I should be long.”

What most traders don’t realize is the market drives the talking head’s conversation, not the other way around. Whatever the direction of the day is, the discussion follows like a fart in the wind.

The more you listen, the more confused you’re prone to become.

Markets go back and forth on all time frames. If a weekly chart is running a test of some lower prices to double check areas of importance, the daily chart and intraday charts can look like an all out rodeo.

Traders that don’t have an understanding of how markets and charts work are subject to a never ending quest for information, not realizing their entire process is flawed. They’re looking for the answers from people who have no idea their own bias is driven by the very price action their trying to predict…

🏆MEMBERS SAYIN’

David is an amazing teacher…he has changed everything about how I operate. Really appreciate you brother! Shannon B.

COMMON SENSE MARKET STUFF EVERY DAY

DISCLAIMER STUFF: Nothing found in this communication is financial advice. This newsletter is strictly educational and not intended for or should be thought of as investment advice or a solicitation to buy or sell any assets or to make any financial decisions whatsoever. Please be careful and always do your own homework.