- OnTheDocket

- Posts

- Don't Feed The Beast

Don't Feed The Beast

⚾PRE GAME WARMUP

How about a Little overnight pull back operation conducted by the overnight crew… Normal garden variety retracement behavior.

The big deal for the bulls today will be the ability to bolt on a follow through day and "break the bear chain..."

Getting right to the meat and potato's, she's got some unfinished business above yesterdays high. Getting above yesterday's close around 424.71 is needed to open the door for the [member login] zone. Above on candle closes will open the door for the next leg higher which will be provided in a real time situation as and if needed...

The flip side is staying below [member login] because it cracks the door open to fall down to the same place Mrs. Market broke out from yesterday, we'll call it [member login]. Below that for more than just a spike will be the bear case for a rug pull event and the advent of new lows...

Is the trick, trap, fool and frustrate crew ready to screw the shorts?

🎬THINK IN PICTURES

We’re talkin’ dividend trap time. Many investors get sucked into the conversation about how certain stocks carry big dividends, because “stocks are cheap.”

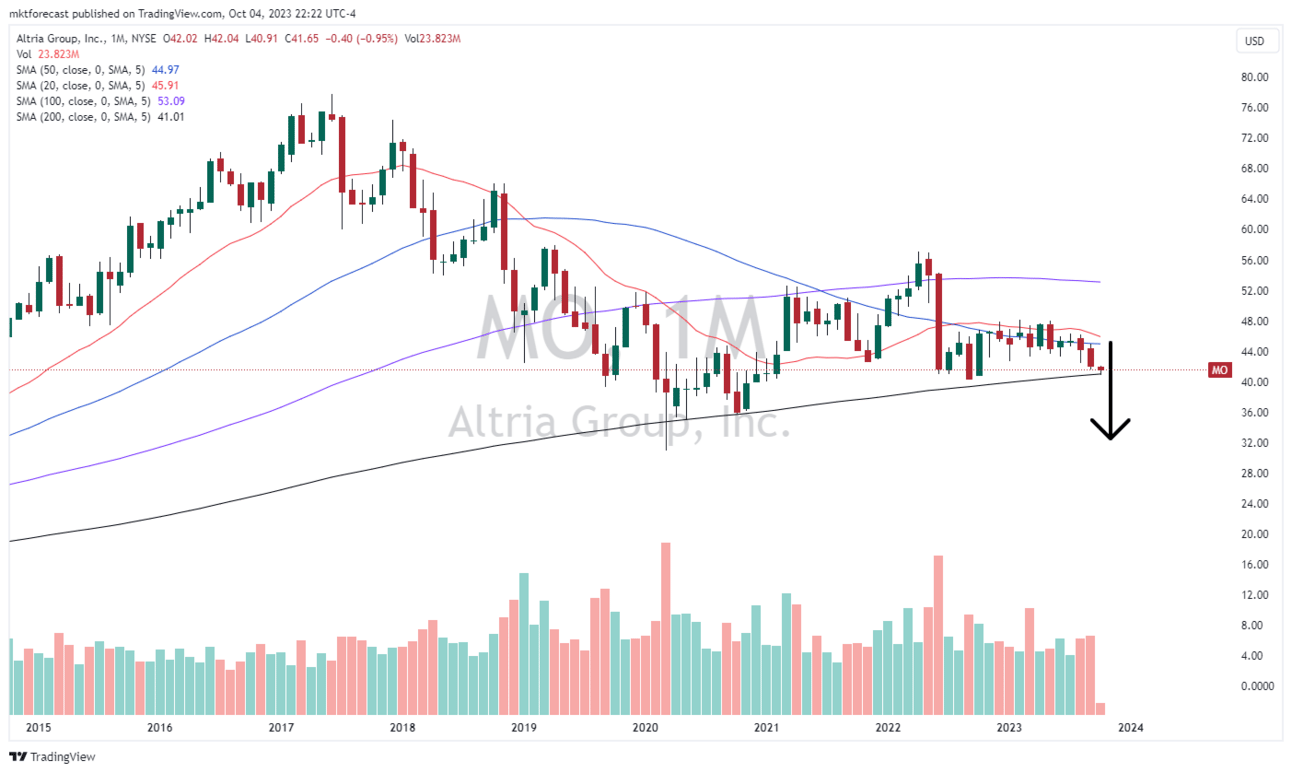

Let’s take a look at Altria Group (Big MO) for example. As of yesterdays close, the stock is yielding 9.53%. Sounds juicy!

Until you look at the long term monthly chart. Here’s the way I see it. The stock tested, retested and traded away from the 200 period moving average. Then it came back and did it again. Now she’s come back on more time only to hover on top of it. Looks to me like it’s riding the 200 MA, and employing the concept where the more times they hit it and the longer they hang around, it’s eventually will give way.

What’s more? If symmetry has her say, this thing is going down to the 32 - 33 dollar area - over time…

Don’t fall for the oldest trick on the book.

Share OntheDOCKET With a Friend

You currently have 0 referrals, only 5 away from receiving Free Month InsideTheNumbers LIVE.

💣WRECKONOMICS

The Food Stamp Program administered by the U.S. Department of Agriculture is “proud” to be distributing this year the greatest amount of free meals and food stamps ever, to around 46 million people. That’s a big number and represents around thirteen percent of the population (at least the ones we know about).

Enter the National Park Service, administered by the Department of the Interior who has a policy that says “Please Do Not Feed the Animals.” Their stated reason for the directive is because “The animals will grow dependent on handouts and will not learn to take care of themselves.”

Is this the twilight zone?

🩺PSYCH WARD

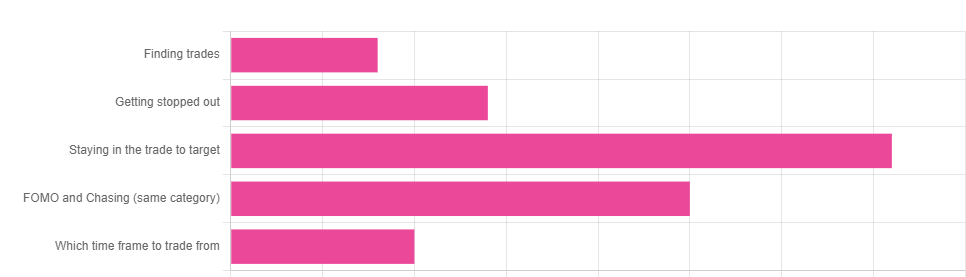

Yesterday we took a trader poll to see what burning thing causes you the biggest problems preventing big time money making situations…

Staying in the trade to target was the biggest challenge facing traders. It makes sense, we discuss this every single day in the LIVE Room.

Exactly what do we discuss and how do we solve the problem?

It’s simple but not easy. We go with the concept of “base hits put you in the hall of fame.” We know the numbers and we know what happens at the numbers the large majority of time. We enter trades with the expectation of more than one exit. They’re called scalps with potential.

For example, when trading the ES Futures (ES & MES) we book a base hit between 5 - 7 ES points and hold a portion of the trade for the “never know.” We never know which ones are going to give us the rocket ride for another 10 or 20 points, or more…

Sometimes after we exit and put the base hit in our pocket, the market comes back down and stops us out on the remainder. So what, we have a profit and we wait for a lower price to re-enter, or simply for the next trade, next base hit with potential.

We bring you into this line of thinking, one trade at a time.

🏆MEMBERS SAYIN’

I broke out the credit card this morning and jumped in. Much appreciated. Rich B.

First day back in the live room in a couple of months... $4000+ today. Thanks David! @jsm9153

COMMON SENSE MARKET STUFF EVERY DAY

DISCLAIMER STUFF: Nothing found in this communication is financial advice. This newsletter is strictly educational and not intended for or should be thought of as investment advice or a solicitation to buy or sell any assets or to make any financial decisions whatsoever. Please be careful and always do your own homework.