- OnTheDocket

- Posts

- Check your shorts, it's "Kick The Can Season"

Check your shorts, it's "Kick The Can Season"

⚾PRE GAME WARMUP

Happy Monday...

Markets have a slobbering love affair with government spending. It’s no wonder they got a solid gap higher open Sunday night. Then at around zero dark thirty they were smacked back down as a reminder these are all bounces in a downtrend until they’re not…

Let’s get down to the short story of the numbers. We’ll use [Login here] as the bull pivot meaning above and the door opens for another leg higher...

At which point the discussion on Tout TV will turn back to “soft landing,” “investing is for the long term” and of course our favorite pundit talking point, “stocks are cheap.”

We’ll come to the window with higher numbers as and if needed in a real time situation…

If we have a bull pivot, then we need a bear one to match. We’ll start the morning session off with the obvious at [Login here]. Getting below and staying that way for more than just a few minutes will open the door for another leg lower starting with a spike below [Login here]...

Any more than that will promote another leg lower and more importantly bring another failed rally and lower lows into the conversation…

We’ll handle this stuff in real time as and if needed.

🎬THINK IN PICTURES

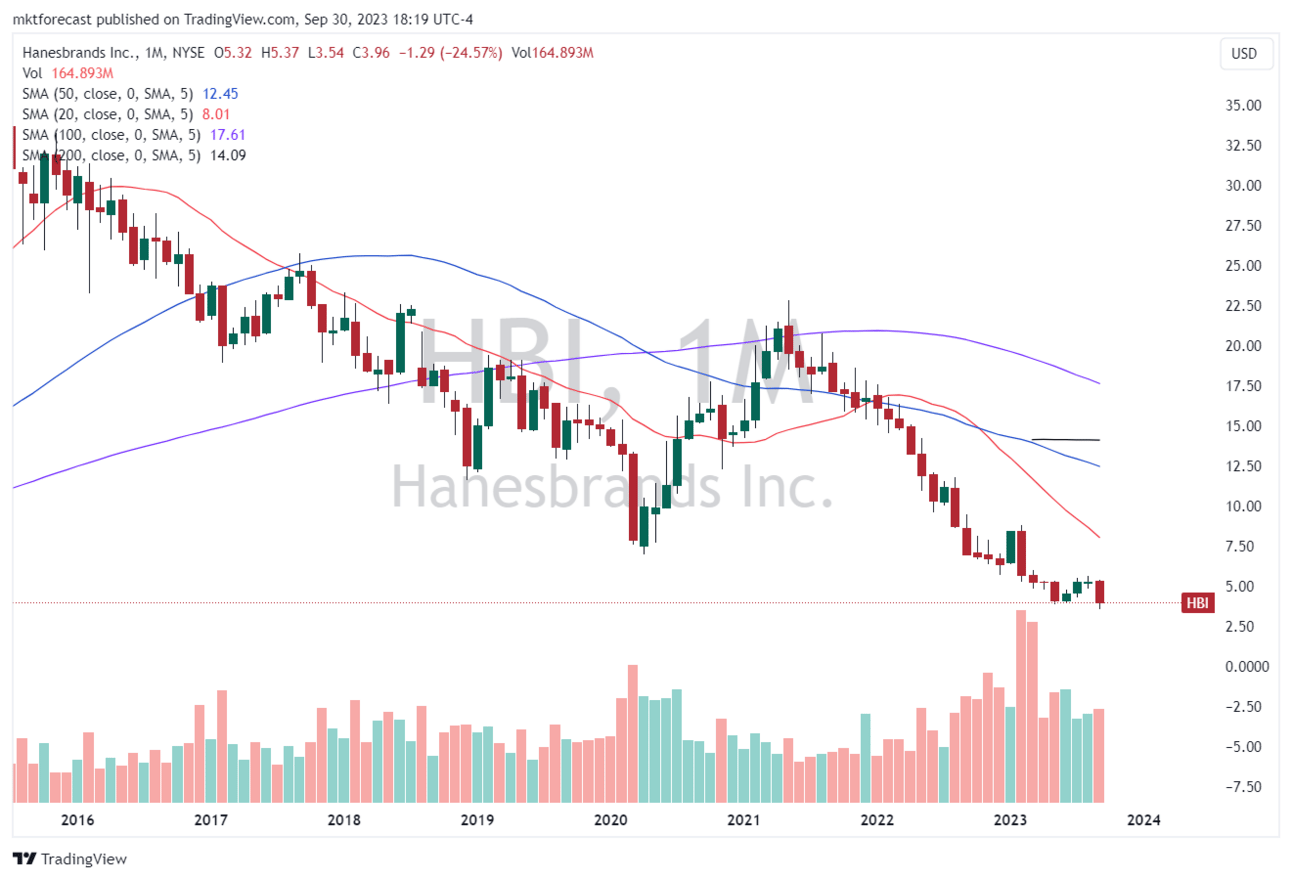

This one speaks for itself. When men feel the squeeze and need to cut back spending, some of the most obscure things get recycled. Should we take Hanes at face value?

The premise behind the MUI (Men’s underwear index) is that men's underwear are a necessity in normal economic times and sales remain stable.

However, during an economic downturn, demand changes as new purchases are deferred. Hence, men's purchasing habits for underwear (and that of a spouses on their behalf) is thought to be a decent indicator of expendable discretionary spending.

🌗RECYCLE TIN FOIL HAT

October always brings interesting conversation to the table. Two of the largest panic crashes in history occurred this month. One in 1929 and the other 1987.

We’ll watch the middle of the month for some negative energy likely driving some shaky news items.

Share OnTheDocket

You currently have 0 referrals, only 5 away from receiving Free Month InsideTheNumbers LIVE.

Or copy and paste this link to others: https://onthedocket.mystrategicforecast.com/subscribe?ref=PLACEHOLDER

💣WRECKONOMICS

They’re predicable as the sunrise or a trader showing up each morning looking for a trade.

Ever wonder why the right decision is the impossible decision? Imagine for a moment the people responsible for running the country, [and its financial well being] got together and created a budget and spending plan that would begin to steer the ship in the right direction. They don’t have to solve the problem with one vote, but how about make a freakin’ effort…

Instead, every so often congress votes to apply for a new credit card with a freshly minted borrowing limit.

What really happens?

Both sides of the [blurred] isle need the band to keep playing on to continue the charade called, “pretend we give it shit about the peoples money.”

Use logic. How do they get re-elected? By asking for money and making promises that are mainly fulfilled with, wait for it… Money.

So less spending equals less giving a way stuff.

They lobby within the halls of congress to insert funding for this that and the other thing into bills. It’s called pork spending and was invented right around the time of fire.

Without the never ending stream of credit cards (who gets all those miles?), they couldn’t possibly continue getting re-elected.

You do the math, heads they win, tails your lose…

🩺PSYCH WARD

You don’t have to be old to know about the Rocky movies. Think back to the Italian Stallion training with Micky. He needed speed so Rocky found himself in a yard chasing a chicken. How many times are you going to actually catch the chicken. Few and far between.

Now think about chasing a stock while it’s rising because you were afraid to miss it. (FOMO)

By the time you see the move happening, decide to “jump on” the trade, and finally enter an order, they’re just about to reach a critical resistance number.

You chase, you buy, it pulls back immediately, you second guess the trade, take a loss, right before she immediately goes back up… Know this one?

Now you have to get your money back, so you do it again. After three or four of these, you’re now in the revenge trade business…

Moral of the story, don’t chase. You buy support or sell resistance. If you don’t know where they are - there is no trade!

🏆MEMBERS SAYIN’

Your numbers make me money. Robert Q.

You rock, thank you. Renee H.

COMMON SENSE MARKET STUFF EVERY DAY

DISCLAIMER STUFF: Nothing found in this communication is financial advice. This newsletter is strictly educational and not intended for or should be thought of as investment advice or a solicitation to buy or sell any assets or to make any financial decisions whatsoever. Please be careful and always do your own homework.