- OnTheDocket

- Posts

- Tried and True Economic Indicator Speaking Volumes

Tried and True Economic Indicator Speaking Volumes

⚾PRE GAME WARMUP

It's turnaround Tuesday.

A little pull back operation sponsored by the overnight crew, which can be of the bullish variety of she stays shallow. Here's how the chart setup matches with the numbers this morning...

As long as Mrs. Market stays above Member Login, the band can continue playing on. Member Login is what we'll call the bull pivot today. Above on candle closes and she begins to run some tests of yesterdays highs and likely higher...

Let's say she punches through yesterdays highs, the main objective becomes 438.60 for the reasons discussed in last nights video...

The flip side is getting below Member Login which opens the door for lower stuff, which gives the look of a whole different tape and the door opens for 432.90 and then 431.55...

🎬THINK IN PICTURES

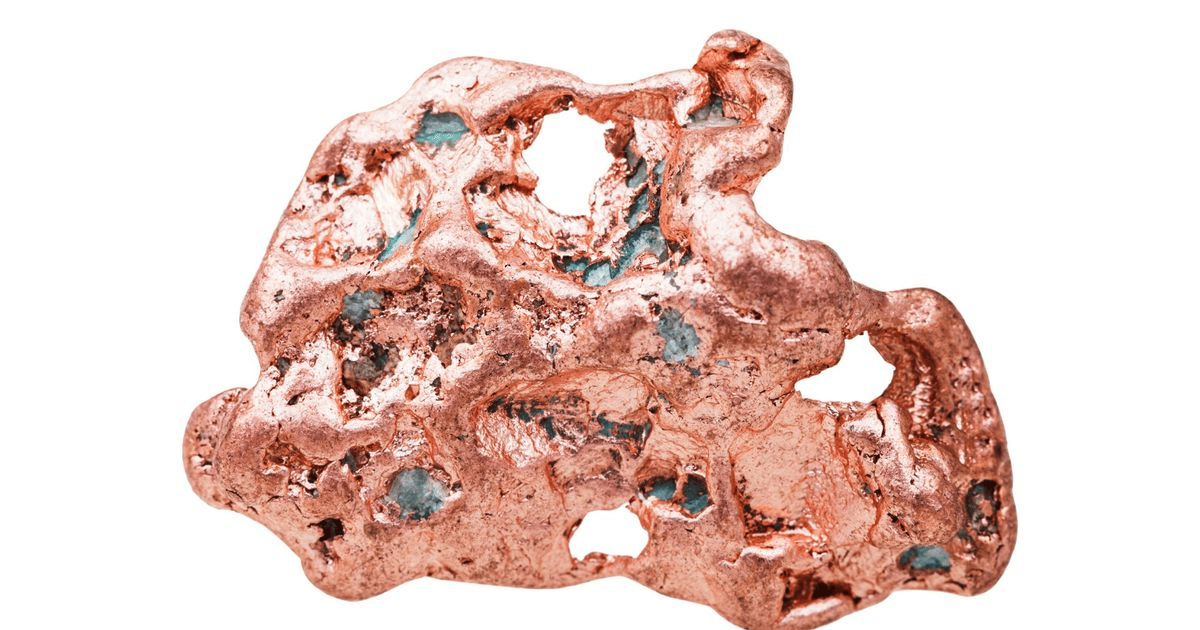

How about a tried and true indication of how the global economy is doing?

The chart below is of Copper. The metal is used in countless industrial applications and has always been a great proxy for the health of economic activity.

It’s the common sense supply and demand thing. The more demand for copper the higher price goes, the less demand, the lower price becomes.

What we have here is a failed breakout and a series of lower highs which is of the bearish variety.

3.32 is the magic number. Getting below and staying below is the case for more bearish activity and a prolonged economic downturn.

Share OnTheDocket

You currently have 0 referrals, only 5 away from receiving Free Month InsideTheNumbers LIVE.

💣RECKONOMICS

The United States is now funding two wars, one in the Ukraine and the other in Israel. Think we’ll get paid back? Who pulls the strings?

Let’s say one of the big private equity firms invests in a company. In exchange for the investment they take an ownership position including a couple of seats at the table by way of the board of directors.

This means decision making power. Does anyone think if we’re funding wars, for whatever the reason, we don’t have a seat at the table?

Translation, we’re as involved in the eyes of the world as the boots on the ground…

Wars can be inflationary, to a point. Let’s take the case of Israel. It’s a small country (who packs a big punch) in the middle of nowhere. If it’s contained, the markets will shrug it off and focus on the manufacturing that will occur to keep the rockets flying, the troops equipped and the rebuilding efforts going…

But what happens if the thing spreads beyond the sliver of land called Gaza? then the real geo politics spreads, US troops and arsenal gets involved and the old “uncertainty” floods into markets creating the unknown…

The lesson is not to overstay your welcome on the long side of the market as it’s a traders tape. Have the awareness things can change on a dime, likely overnight, out of the blue with a big gap down open…

It’s the inevitable….

🩺PSYCH WARD

When a day trade turns into a swing trade.

We all know this one. You take a trade, it goes against you, next scene shows you’re holding an overnight trade you didn’t plan on.

Learning how to take a loss prevents the trade from turning into an investment. Grant it, sometimes holding overnight works in your favor. However consider what actually happened.

You took a trade based on a specific thing. the thing that was supposed to happen on the chart changed, price went the other way and now the reason you took the trade no longer exists.

This is where learning how to admit you were wrong is the big boy (or girl) stuff that separates the pros from the pajama jockey’s slash rookies who refuse to “take the hit.”

First loss best loss is a lesson all traders learn the hard way. Avoid the times where you hold overnight, wake up to a gap down and now the hole just got deeper. What could have been a $500 loss turns into $2,500 by the next morning.

We know what happens next. More hopium, some bad decisions with a few revenge trades sprinkled on top.

Put your big boy (or girl) pants on, take the loss and move on to the next trade and live to trade another day with a clear head and better mindset.

Don’t make two errors on the same play, one is enough.

🏆MEMBERS SAYIN’

Knowing the numbers is like looking behind the curtain at a magic show, you realize what you didn’t see before. Jerry R.

COMMON SENSE MARKET STUFF EVERY DAY

DISCLAIMER STUFF: Nothing found in this communication is financial advice. This newsletter is strictly educational and not intended for or should be thought of as investment advice or a solicitation to buy or sell any assets or to make any financial decisions whatsoever. Please be careful and always do your own homework.