- OnTheDocket

- Posts

- Correct About Bond Yields & Stock Prices

Correct About Bond Yields & Stock Prices

⚾PRE GAME WARMUP

It's hump day already and looks can be deceiving. It's a wake up flat kind of situation, but with a twist...

The thieves in the night already did the thing down at the place discussed in last nights video, you know around 418.50 give or take. Funny how this works, isn't it?

What’s more, the 10-Year Treasury bond almost got to the place up around 4.89%, making a high overnight at 4.884% before the reversal in the ES Futures back up while bond yields pulled back. So we’re right on that one too…

We already know the first question, will they be back or was that it for a while? We don't know, which is why we prepare for anything. Yesterday's low of 420.18 will be the gateway to lower numbers...

The next one in line is the place, we'll call it 418.50 give or take... (Actual is 418.31). The flip side and hint that we don't need to look down for a while is getting above 422.50 on candle closes. This will create the lane for another leg higher to be posted and discussed in a real time formation...

Remember, whenever they are done with this down phase, there will be a rip your face off rally to squeeze out the shorts...

We don't know for sure, but the place discussed last night is a good candidate for an interim low. Awareness.

🎬THINK IN PICTURES

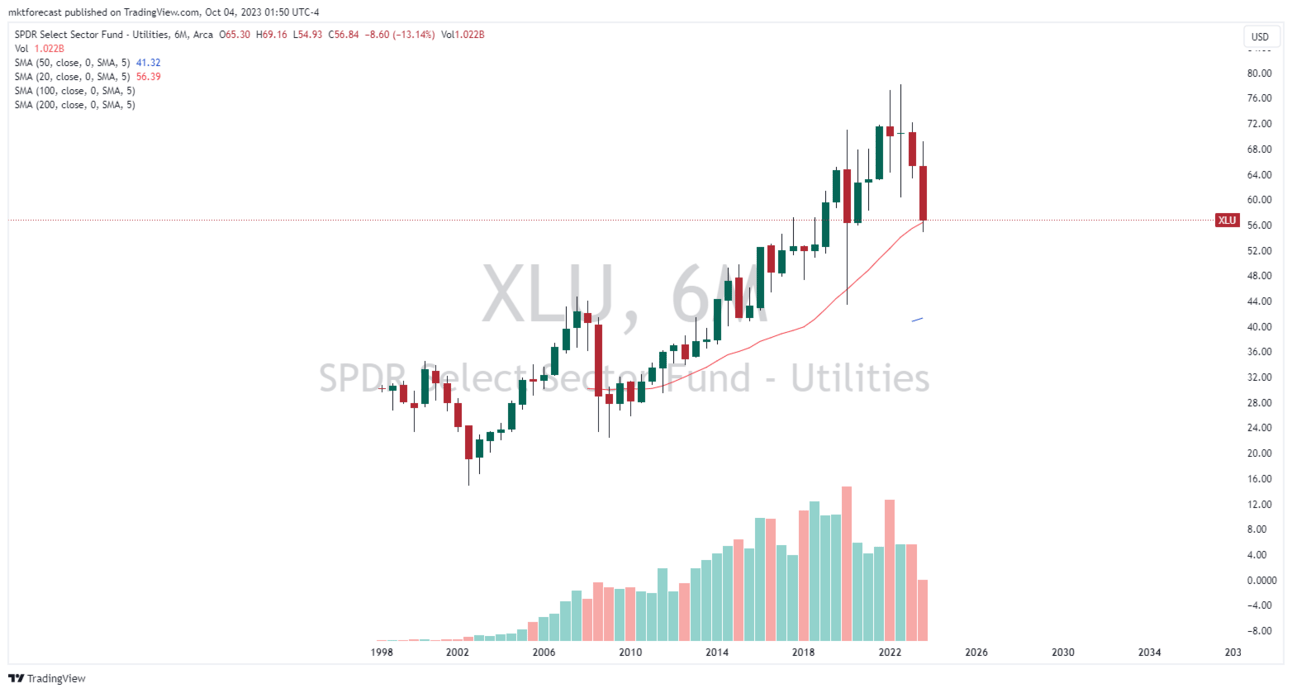

Utilities have been getting crushed. Here’s another example of how “all charts act and react” the same way.

The chart below is a long term six month time frame of the XLU, one of the Utilities exchange trade funds. The red trendline is the twenty period moving average or as we like to say “home base…” They got a little far away and came back to check in at “home base.” Moral of the story is you need to be looking at a variety of time frames, Mrs. Market is always telling a story on at least one of them…

❓TAKE THE POLL

Share OnTheDocket

You currently have 0 referrals, only 5 away from receiving Free Month InsideTheNumbers LIVE.

💣WRECKONOMICS

FedNow will revolutionize the payment and funds transfer business in many different ways. Some not so welcome…

The initial roll out of FedNow is designed to eliminate the antiquated clearing house for funds that travel between banks, causing a delay in payments. You know how when you write a check or transfer money how sometimes it takes a few days? Where was the money and who’s getting the interest?

Well, that’s all been solved for the greater good right?

Well, it’s a multi stage process. First the technology gets rolled out to institutions so the average every day Joe and Jane can get familiar with how better things become with “instant payments” regardless of where or who you send money to.

Enter, the next phase. Once FedNow becomes a household name, they start with mission creep.

Think Crypto and how people started to become comfortable with the idea of Bitcoin, Ethereum and many fake tokens as a replacement for the dollar. Well, not so fast. There was a crash in crypto to wipe out many of the charlatans such as the FTX dude and other fast talking thieves which left the public rightfully suspicious.

However, you trust the banks and you certainly trust the Fed, right?

Wait until you find out that every person, legal or illegal, young and old, rich or poor will wind up with an account at the central bank called FedNow.

This will be the beginning of the end for the Dixie (US Dollar), paper money and all cash transactions.

Once the Government has a new mechanism for how we account for, spend and save money, they can reach much deeper into what we do, how we do it and when we do it. Think this is a bunch of hog wash?

🩺PSYCH WARD

Do you constantly get stopped out right before the market takes off?

There’s a couple of reason why. First, you’re putting a stop in the system or trading platform for the world to see. Once your order is shown to the market, the computers will “come and get it…” Their programs are designed to pick up the small trader orders with a few hundred or a even a few thousand shares of stocks who’s stop is out there waiting.

Institutions on the other hand play the accumulation game. Here’s how it works without you even realizing it. Markets will trade in a range that most traders won’t take the time to identify. Stock goes up, retail traders chase the tape. Once they get “in the money” you put in a stop ensuring you don’t lose money. Market pulls back, driven by institutions who are looking to buy (they don’t chase). As price heads toward the bottom of the range, the stops are liquidity for those looking to purchase in “accumulation” phase…

What’s next? Your stop gets triggered in the lower portion of the range, right before the institutions drive price back up. Happens all day every day.

How you avoid this? Don’t show your stop order to the market and learn where support and resistance is by having a full and complete understanding of how markets and charts work.

Start thinking like the big guys and stop being their pray. We take trades at the correct place at the correct time to avoid these common pitfalls.

🏆MEMBERS SAYIN’

Appreciate all the knowledge you share. It really helps young clueless investors like myself understand the intricacies of this complex mama jama. Zestme479

COMMON SENSE MARKET STUFF EVERY DAY

DISCLAIMER STUFF: Nothing found in this communication is financial advice. This newsletter is strictly educational and not intended for or should be thought of as investment advice or a solicitation to buy or sell any assets or to make any financial decisions whatsoever. Please be careful and always do your own homework.